The TaxCrawler product is a lead generation engine that presents refined and validated tax cases in Excel format as shown below. It contains critical information on each lead for further analysis and background checking by a tax discovery auditor to increase revenues for the city, municipality or state. TaxCrawler can be used for:

- finding missing Hotel Occupancy Tax, Transient Occupancy Tax, Lodging Tax due to Short term rentals on AirBnB, HomeAway, Flipkey, etc.

- finding taxable service providers in the cash economy, such as appliance repair, lawn care, carpet cleaning, automotive service, etc.

- Finding warehouse, fulfillment or distribution center physical nexus for out-of-state retailers

- Finding contraband Tobacco and Cannabis on Darkweb

- identifying Click-Thru Affiliate Nexus for marketing affiliates with in-state businesses

- finding High profile E-commerce Sellers on online marketplaces

- finding unpaid sales tax on Montana-registered RVs and boats

- Same-day shipping / logistics / warehousing creates a physical nexus for sales tax collection

- Use Harmari Search to find untaxed tobacco or cannabis on Craigslist and other websites

- Click-thru affiliate nexus is now legislated in dozens of states for online marketplaces

- Use Taxcrawler to identify use tax on Montana registered RVs garaged in your state

- Sample taxable services and reviews / business activity on Angieslist

- STR Short Term Rental Identification and Monitoring

- Use Taxcrawler to identify use tax on Montana registered boats docked in your state

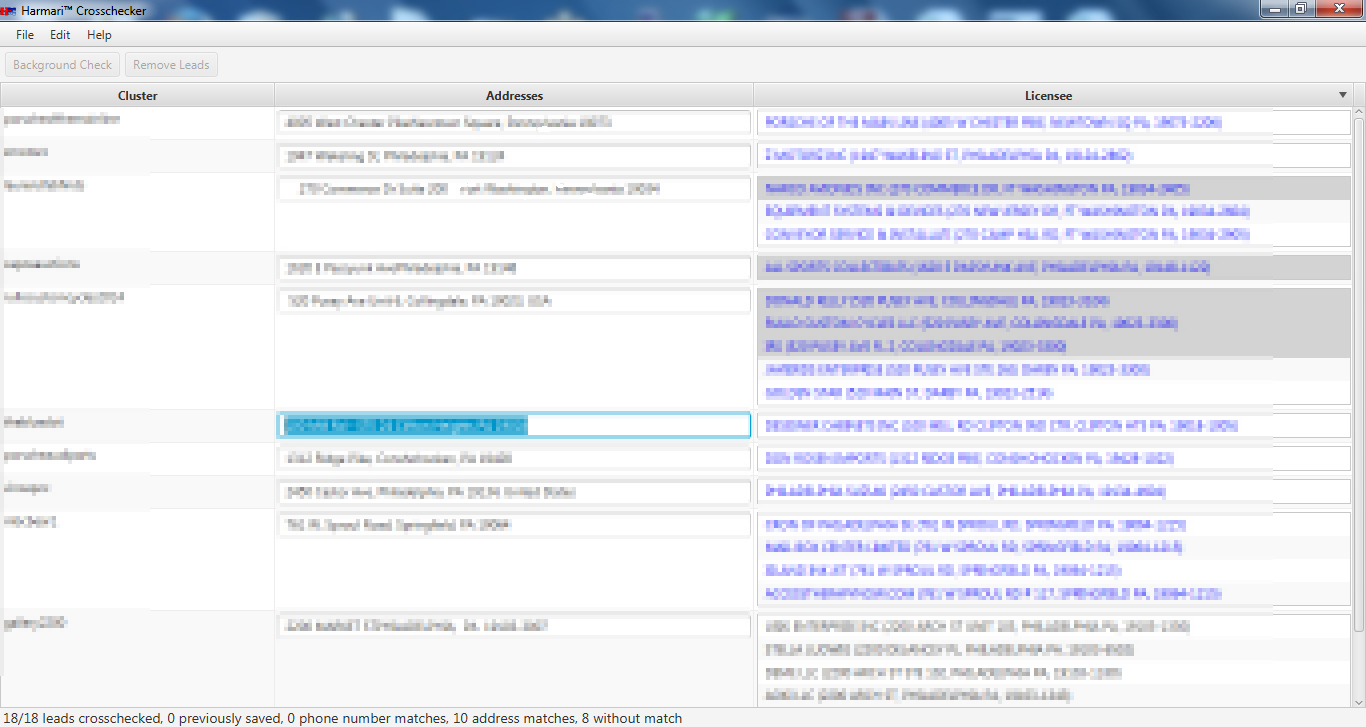

Coupled with TaxCrawler is the Cross-checker utility, which makes easy work of comparing each lead against exact and near-matches on business name, phone number, and address. The results are again saved to Excel for follow up, and Cross-checker is so easy to use you don’t need IT resources to make it work.

To learn more about Harmari Taxcrawler, please contact us by filling out this form below