Many tax collection jurisdictions at the city, county, state and federal level have arranged voluntary collection agreements with Airbnb and/or HomeAway, the two biggest short term rental platforms in the world. While it may be easier to collect the tax from those 2 agencies than from potentially tens of thousands of STR operators, there is still room for tax leakage. Tax collection departments must be vigilant with these four types of tax leakage

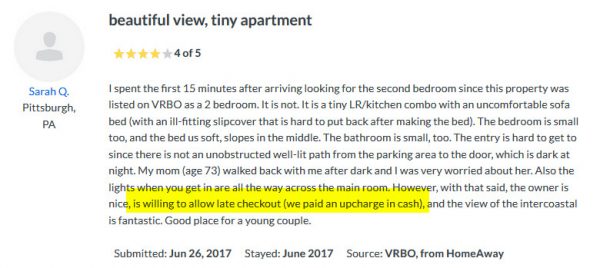

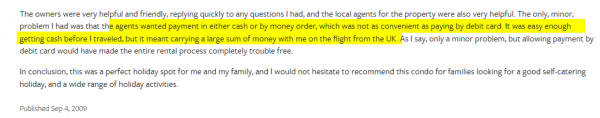

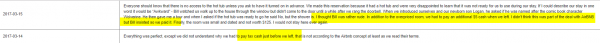

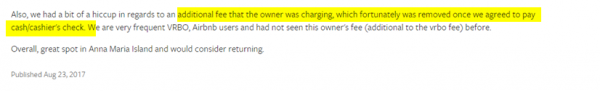

Tax Leakage #1: Extended Stay. Guests book through the platform of their choice for a weekend. The operator accepts payment and taxes are collected as expected. But then, the plans change and guests ask to stay an extra day (or two), or perhaps a late check-out. The operator asks them to pay cash or e-transfer to extend the stay, and pay off-platform

Tax Leakage #2: Bait and Switch Upcharge. A tactic used by hotels and STR operators alike. The guest a books a 1 bedroom downtown for $175. Then when the guest tries to check-in, the operator notifies her that the room is unavailable but not to worry. He has another place 2 blocks away and it’s a 2 bedroom suite for $225. Stuck in a bind during the festival season, the guest is unable to find anywhere else at the last minute and is basically blackmailed into paying the upcharge on the room. Again, the operator asks for an off-platform payment to complete the transaction.

Tax Leakage #3: Overcharge the tax. For a guest that doesn’t know any better, he’ll go along with the tax rate to be collected on the final bill. This happens in times when the jurisdiction does not have a tax collection deal with the platform e.g. Hawaii and Florida (depending on the County). So there’s a large variance in the tax rate that is collected by the STR operator, and depending on the circumstances a possible over-charging on the tax rate.

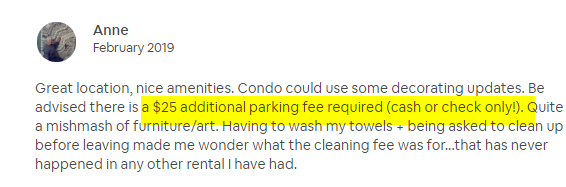

Tax Leakage #4: Optional fees. If you read the fine print on some STR listings, you’ll notice there are ancillary fees that are not covered in the original booking. This is not a comprehensive list but extra costs can be incurred for the following:

- Children, pets or extra guests

- Use of firewood, torches, propane, pool heating, jacuzzi usage

- Parking pass, boat slips

- Resort, Club or Amenities Fees

- Laundry and Linen Fees

Tax Leakage #5: Off-platform Booking. Of all the tax leakage sources listed here, none are as significant as off-platform bookings. The STR operator simply takes advantage of the fact that people are creatures of habit. If the guest is a family that always has a ski trip in February, or always visits the beach on July 4th weekend, then chances are that they will come back year after year. Once the initial booking is made on the platform, the guest and operator meet. They exchange contact information, and then the booking simply happens off-platform for the second and subsequent year that they visit.

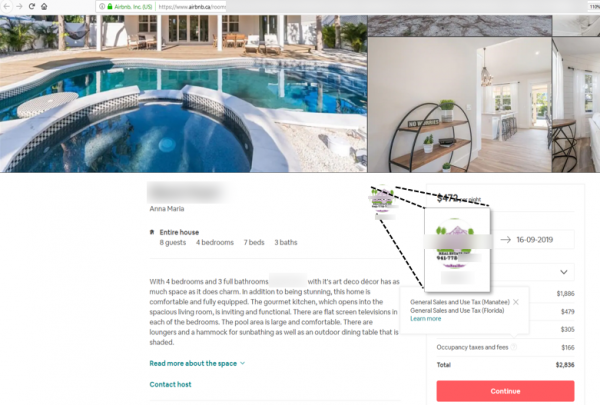

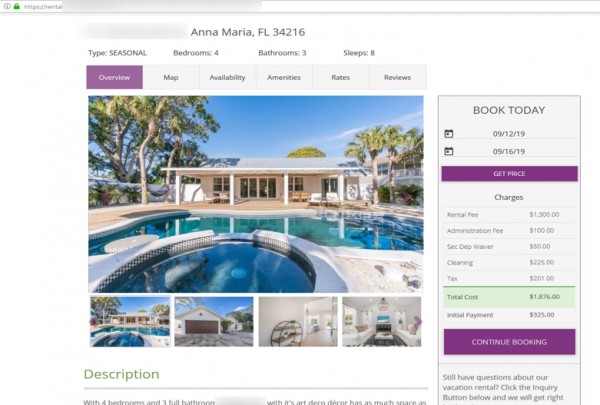

Below observe a property listed for a 4-bedroom house in central Florida. If you look closely, the avatar contains a phone number which beckons the user to call. By calling, the guest circumvents the normal booking and payment processing mechanism, and furthermore may save taxes and platform booking fees. In fact, we found the rental company had an e-commerce site where the booking can directly take place. So the opportunity to save a buck is not lost on some guests; they will be happy to save a buck.

-

STR listing with direct contact information displayed -

STR listing off-platform from operator with discount booking capability

Harmari staff have painstakingly researched past booking data over a 9-month period for about 4000 unique short term rentals listed on the main platforms in central Florida, from October 2018 through June 2019. The goal was to identify gaps in reserved dates on a calendar with review-based revenue estimates. By analyzing the data, an average tax gap of 76.8 unaccounted for nights was found, which resulted in a total tax gap of $2.2M. Furthermore, there is a way to prove that the unaccounted for nights are attributed to revenue-generating stays based on prior behavior of owner/operators. Harmari STR can generate this report to help with under-reporting detection, and to maximize revenue for a tax discovery project.