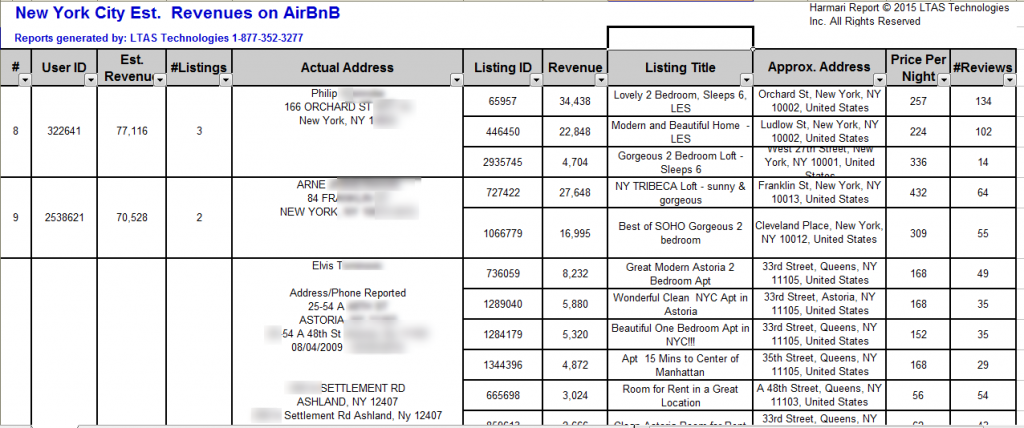

Municipalities seek to bridge the tax gap by ensuring that property owners who provide short-term vacation rentals are paying their registration and rental tax obligations. Short term vacation rental (STR) sites such as VRBO, HomeAway, AirBnB and others make it easy for property owners to advertise their short term rental (less than 30 days) to guests. The challenge is that many of those rental sites do not provide an easy means to establish the exact address of those properties, and also the exact identity of the owner. The Short Term Rentals report delivers clues to these vital pieces of information to municipalities in a user-friendly report.

- Exact Street Address verified to the property listed via property tax records

- Estimated incomes based upon reviews, minimum nights, and rate-per-night

- Automatic lookup of the latest public phone number records from trusted sources

- Triangulation of Operator full name via social media, review data, public records, and property records

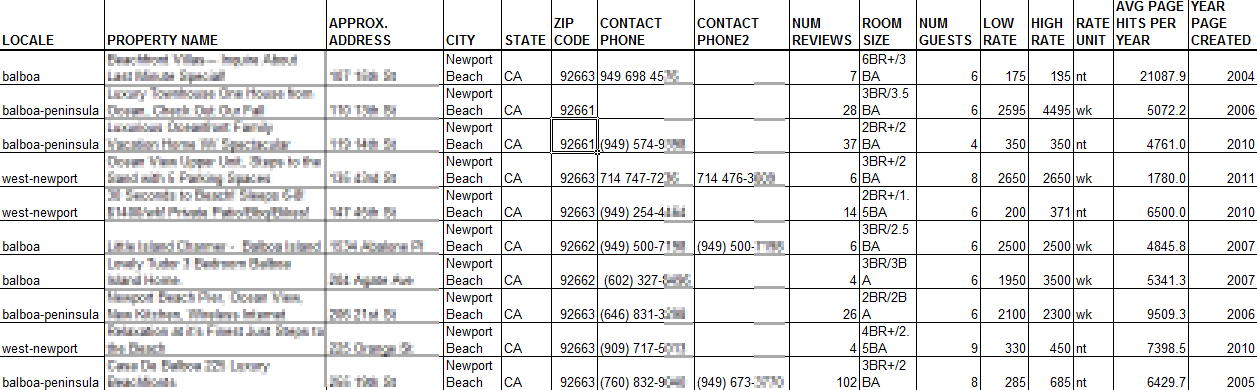

Here is a sample from VRBO data on Newport Beach, CA

Find out more at our short term rental tax page.